In the vast ocean of economics, one term that often sends shivers down the spine of policymakers and citizens alike is inflation. Imagine a world where your hard-earned money loses its purchasing power faster than ice cream melts on a hot summer’s day. Well, that’s precisely what inflation does, and it’s no friend to the economy.

Inflation, in simple terms, is the rise in the general price level of goods and services over time. While a mild inflationary environment is considered normal, excessive inflation can wreak havoc on an economy. Let’s dive into the reasons why inflation is perceived as the villain in this economic drama.

First and foremost, inflation erodes the purchasing power of money. Think of your wallet as a superhero cape that loses its magical powers when exposed to inflation. Suddenly, that $100 bill doesn’t stretch as far as it used to, and the cost of your favourite morning coffee or monthly rent keeps creeping upward. This relentless decrease in purchasing power diminishes the standard of living for individuals and can lead to a reduction in real wages.

Additionally, inflation creates uncertainty in the economic landscape. Businesses rely on stable prices to plan for the future. When the inflation dragon starts to breathe fire it becomes challenging for companies to predict costs accurately. This uncertainty can hamper investment, slow down economic growth, and leave businesses hesitant to expand or hire new employees. This isn’t good for jobs and the economy.

Moreover, inflation introduces an element of unfairness in wealth distribution. Those, such a retirees and anyone on a government benefit, who are on fixed incomes or hold cash savings see the real value of their assets decline. It’s like playing a board game where some players get more money each time they pass “Go” while others watch helplessly as their earnings dwindle. This wealth redistribution can worsen social inequalities and leave vulnerable populations at a greater disadvantage.

Now that we’ve established why inflation is a formidable foe, let’s turn our attention to the knight in shining armour – monetary policy. This powerful tool is wielded by central banks to maintain price stability and foster a conducive economic environment. But how exactly does monetary policy combat the menace of inflation?

One primary instrument in the central bank’s toolkit is interest rates. By adjusting interest rates, central banks can influence the level of spending and investment in the economy. When inflation is on the rise, central banks may raise interest rates to make borrowing more expensive and to leave less disposable income in people’s pockets. This, in turn, is intended to curb spending and investment, putting a brake on the overall demand for goods and services.

Imagine interest rates as the temperature control on your air conditioner. If it gets too hot, you turn it down to cool things off. Similarly, central banks tweak interest rates to cool down an overheated economy plagued by inflation. It’s a delicate dance, though, as setting interest rates too high can stifle economic growth and employment. It’s what global central banks have been doing lately and one thing that is keenly felt by anyone with a home loan that’s seen their monthly repayments rising over the last year or more.

Another powerful weapon – but one we don’t really see – in the central bank’s arsenal is open market operations. Picture the central bank as a puppet master with strings attached to bonds and securities. Through buying or selling these financial instruments in the financial markets, the central bank can influence the money supply. When inflation is soaring, the central bank might sell bonds, absorbing money from the economy and reducing the overall supply. This makes money scarcer and more valuable, acting as a check on inflation.

Furthermore, central banks keep a watchful eye on the broader economic indicators to fine-tune their monetary policy. They analyse unemployment rates, GDP growth, and other key metrics to gauge the health of the economy. If inflation seems poised to gallop out of control, central banks can take pre-emptive measures to keep it in check.

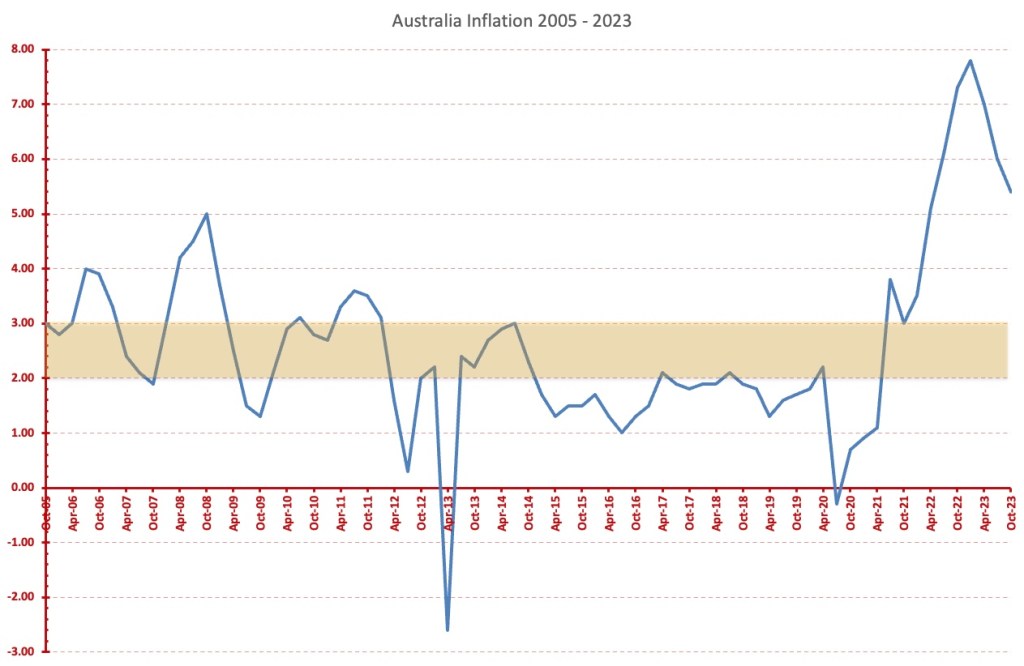

In recent times, the concept of inflation targeting has gained prominence. Central banks such as our Reserve Bank set explicit targets for inflation rates and adjust their monetary policy to ensure these targets are met. In Australia that target is for inflation between 2% and 3%. The chart above shows how far above the preferred inflation rate the Australian economy has been. This approach adds a layer of transparency and predictability to the fight against inflation, allowing businesses and individuals to plan for the future with greater certainty.

While monetary policy is a potent weapon, it’s not without its challenges. Central bankers face the daunting task of balancing the fight against inflation with the need to support economic growth and employment. It’s a delicate tightrope walk where a misstep in either direction can have far-reaching consequences.

The battle against inflation is a critical chapter in the economic narrative. Inflation, with its insidious ability to erode purchasing power, create uncertainty, and exacerbate inequalities, poses a significant threat to the well-being of economies and their citizens. Enter monetary policy, the valiant defender equipped with interest rates, open market operations, and a keen eye on economic indicators. Together, they form a dynamic duo working tirelessly to maintain price stability and foster a healthy economic environment. As we navigate the complex waters of the economy, it’s comforting to know that there are tools in place to keep the menace of inflation at bay.